A generational change is a comprehensive process where many considerations and legal areas must be taken into account to find the best solution for the individual company. At CLEMENS, we have in-depth experience with all aspects of a generational change, so we can guide you safely through the process from the initial considerations to the execution of the transaction.

When transferring a business to a new owner, both the business and the owner's wishes for the future play a crucial role. In addition, there are tax and duty issues, which have a major impact on the financing needs.

There are many areas of law involved in a succession process, including:

- Taxand fiscal matters

- Valuation rules and guidance

- Family and inheritance law, including the connection to wills

- Company law, including opportunities to differentiate influence, finances and ownership share

- Financial matters

- Restructuring, including e.g. spinning off activities prior to generational change

Several of these areas of law are constantly changing. This applies not least to the tax and fiscal framework and valuation practice, where the political winds have also given rise to major shifts in recent years.

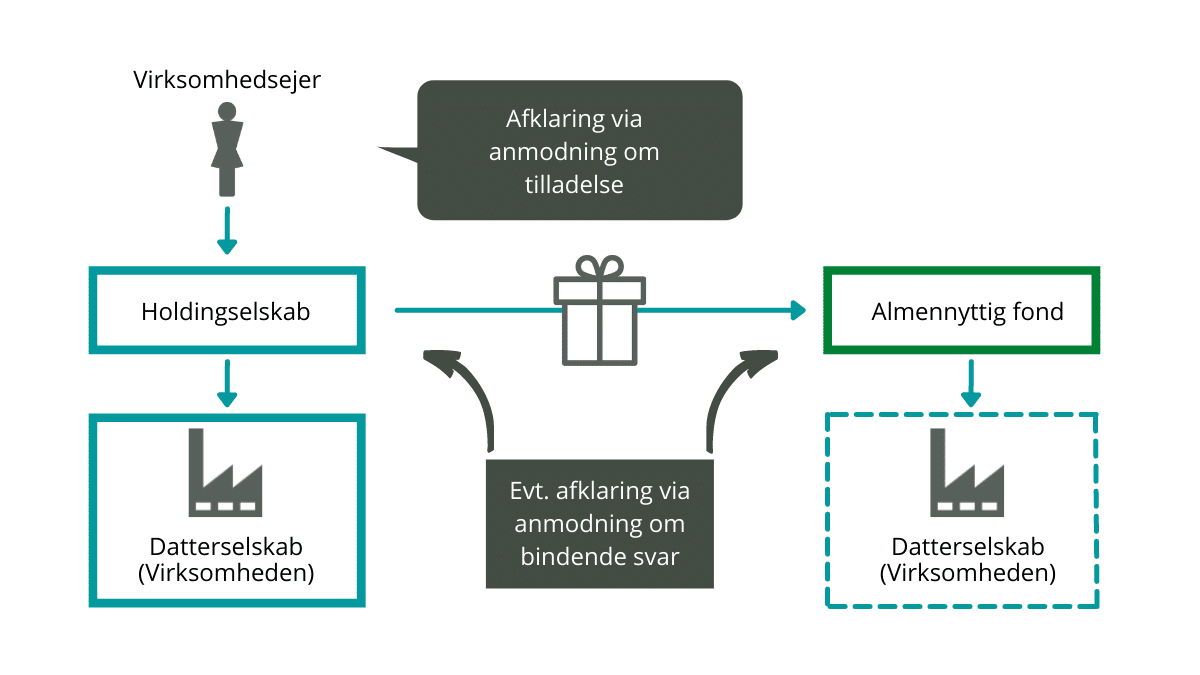

The practice regarding the use of the various generation-skipping transfer models is therefore constantly evolving and the conditions are constantly changing. This applies, for example, to models containing tax deferral according to the rules on transfer with tax succession, where the so-called money tank rule is often the central focal point. This also applies to models with a focus on financing options, including the A/B model, where company law terms on advance dividend rights to the older generation are used to facilitate the buyer's financing needs.

Coherent and holistic advice

We provide coherent advice on all legal aspects of the process, based on our many years of experience and up-to-date knowledge of the relevant rules and practices.

That's why we can keep you safe:

- Good planning for your succession

- Selecting a model based on all relevant considerations

- Minimize the impact on business operations during the process

- Confidence and overview of the process

A coherent consultancy that includes all aspects ensures that the most appropriate succession model is based on the specific wishes. In addition, the organization can reflect the desired pace, possible successive transfers, escalation of influence, etc. And with our extensive experience in designing the legal basis for the overall process, we ensure that the plans can be implemented in accordance with the wishes and considerations of the generational change.

This can be, for example, succession agreements on the ongoing transfer of shares in the company. It can also be in situations where, as part of a generational change, various structural changes must be implemented, which all parties must contribute to.

A generational change is often a complex process, and if inappropriate choices are made along the way or technical errors are made, the consequences can be enormous for both the people involved and the future of the company. We are also often asked to assist in cases where a generational change has unfortunately gone wrong due to overlooked or misinterpreted tax rules. In these cases, it is our job to repair or mitigate the negative consequences.

Are you thinking about succession planning for your business?

When the time for a generational change is approaching, it is very important to be aware of the various options and requirements in relation to taxes and duties, among other things.

We understand the regulations and are of course ready to help you throughout the process. We'll make sure you get the right strategy and proper execution that fits your business. Contact us for a no-obligation discussion about the future plans for your business.