Valuation in connection with generational and ownership change: The issue of taxes and duties takes up a disproportionate amount of time when a company is to change hands in a family. Not least because of the lack of clarity about valuation, explains Attorney Morten Breum-Leer from CLEMENS Law Firm. He therefore welcomes the SVM government's intention for a new model.

Five lines in the SVM government's constitution have attracted particular attention among corporate lawyers and business leaders. The new government will reduce the estate and gift tax on succession from 15 to 10 percent and create a new model for valuation. It doesn't say much more than that, and there are no actual legislative proposals yet, but the SVM government's declaration of intent has nevertheless been well received. A reduction of the inheritance tax from 15 to 10 percent is certainly something to relate to, but there is still a lot of money to be spent, and according to Morten Breum-Leer, Attorney (High Court) and partner at CLEMENS Law Firm, it is actually even more important that something seems to be done about the rules for valuation. Because it is necessary.

"There are many different elements in a generational change, but right now the issue of taxes and duties unfortunately takes up a disproportionate amount of time when a company changes hands in a family, and this is not least due to the lack of clarity around valuation," says Morten Breum-Leer.

Utopian goal

The fundamental challenge with the current valuation model, according to Morten Breum-Leer, is that instead of standardization and robust rules, it has set a more diffuse goal of fair valuation.

"There are two problems with this approach. Firstly, predictability disappears, and secondly, practice shows time and again that the model's basic assumption that you can find and calculate the right value and the right tax is utopian. Cut to the bone, what a buyer is willing to pay for is determined by the future cash flow that the buyer believes they can get from the company. But that expectation is based on a whole bunch of assumptions, which can be subject to varying degrees of disagreement."

Past and future

Then it was somewhat easier to work with valuation in connection with generational and ownership change "in the old days", which is to say until February 2015, when the SR government abolished the rules on valuation according to the so-called wealth tax rate, which with relatively simple mathematical models provided more secure valuations that the parties could agree on.

"The classic models for valuation for generational changes, which we moved away from at the time, were characterized by looking at the company's past. The immediate advantage of this is that you get ascertainable data to work with and it provides predictability. Conversely, a common counter-argument is that old data can be misleading in terms of describing the company's potential going forward. I agree that we shouldn't be looking either 100 percent backwards or 100 percent forwards, but I have noticed that the future is far too important in the current valuation models that people try to trade companies on, and that the valuation that comes out of the effort rarely appears qualified."

Exhausting process

The consequence can be that the seller suddenly has to accept a lower price than agreed. Morten Breum-Leer has experienced a fresh example of this himself.

"In the example, the seller and buyer had agreed on a preliminary price, which was of course conditional on the detailed terms being agreed upon and the due diligence performed by the buyer not giving rise to anything. And nothing new came up. Everything was on the table. Nevertheless, shortly before the deadline, the buyer made a new offer that was 14 percent lower, corresponding to a double-digit million amount. And the seller chose to go along. Not because they wanted to, but because they didn't have the energy to question the new price and prolong the process any further. You can't put something like that into any calculation model, and therefore it's not realistic to believe that a calculation model can be made in such a way that it gives the right value."

According to Morten Breum-Leer, the current legal position means that business owners risk having to spend years pursuing a tax case on the valuation.

"It's exhausting and takes the focus away from the business."

Good for society

According to Morten Breum-Leer, as long as a new and more standardized model for valuation is merely a statement of intent from the SVM government, the issue of taxes and uncertainty about valuation will overshadow many of the qualities and positive perspectives that otherwise characterize generational change.

"In many, many well-functioning Danish companies, there are owners with an understandable desire for family members, who often already have deep insight into the company, to take it over. Family-owned businesses hold many values for society. They are often conscious of the importance of creating and preserving local jobs, and with their roots, they ensure a healthy variety of businesses in the Danish business community. In my view, there is a societal value in the fact that not all companies are consolidated by, for example, being acquired by a private equity fund, but can find a new owner in the family. New rules for valuation should support this. In general, creating sensible framework conditions for our businesses is incredibly important for creating the GDP needed for us as a society to maintain and develop."

Are you facing the big decision of generational change?

At CLEMENS Law Firm, we have in-depth experience with all aspects of a generational change, so we can guide you safely through the process from the initial considerations to the execution of the transaction.

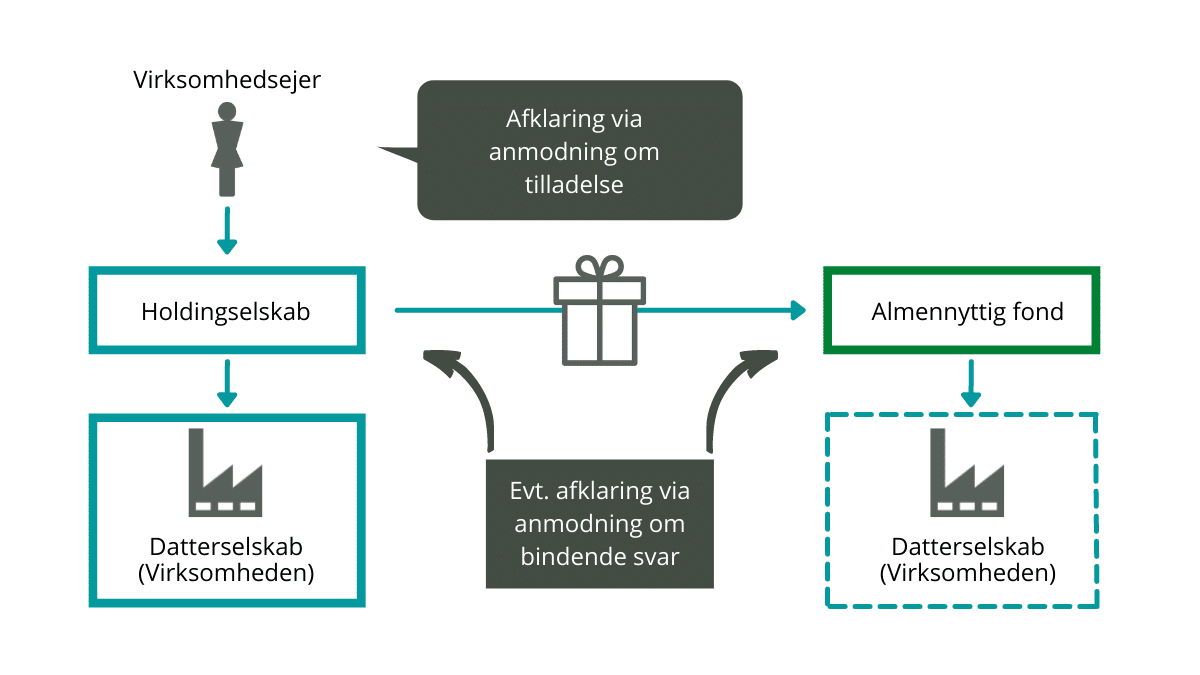

When transferring a business to a new owner, both the business and the owner's wishes for the future play a crucial role. In addition, there are tax and duty issues, which have a major impact on the financing needs. Several of the legal areas that may be relevant in a generational change process are constantly changing, which the above-mentioned announcement from the SVM government is a good example of.

At CLEMENS Law Firm, you are guaranteed coherent advice on all legal aspects of the process, based on your specific wishes combined with our many years of experience and up-to-date insight into the relevant rules and practices. This gives you the best possible conditions for making the right decisions along the way and achieving the most optimal generational change.